We are getting a lot of questions and queries regarding the developing NAV’s driven mainly by the proactive sales campaigning being delivered by some of the leading installers. Whilst competition in new utility connections has been around for some time, the water connection market has probably been the slowest to develop.

This blog aims to give an insight into the market, and highlight some of the benefits and pitfalls to look out for if you are thinking of signing up to a NAV contract on your next development project.

UK Water Companies

In the UK there are now 11 regional water supply and sewerage companies. Scottish and Northern Ireland Water remain publicly owned, but the rest are private companies. They are the largest water companies in the UK and serve the majority of customers, providing both freshwater and sewerage services. These companies are sometimes referred to as ‘incumbents’ or ‘statutory company’ (often shortened to Stats) and are licensed to provide services, including new connections, in a defined geographic area.

New water and sewerage connections – the competitive market

The connections market in the Water Industry is open to competition. When a new development requires water mains or a sewer they can choose whether this is constructed by the licensed water company or by an approved contractor (a process known as self-lay). These approved installersare known as self-lay organisations /providers (SLOs/SLPs). Currently there are about 250 accredited SLP’s approved by the relevant water company or registered under the Water Industry Registration Scheme (WIRS) administered by Lloyd’s Register.

What is a NAV?

If a developer chooses the self-lay route, then the appointed installer applies to the Ofwat (the industry regulator) to request that the location of the development is moved from the previously licenced operator to that of the new installer. This is the New Appointment and Variations process. Importantly, A new appointee has the same duties and responsibilities as the previous statutory water company and are regulated in the same way.

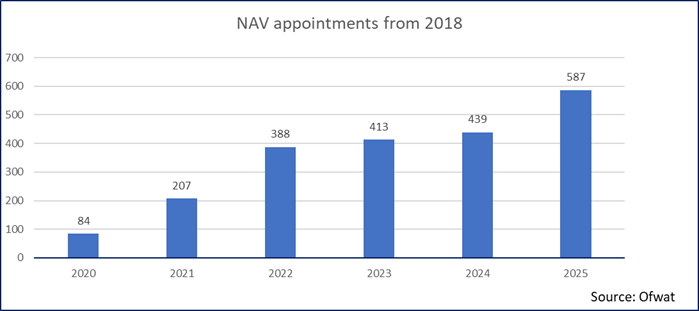

A NAV therefore involves one company replacing another as the appointee for a specific geographic area. A NAV is typically a water asset owner and administrator/collector of customer billing. Currently there are 12 NAV operators licenced via Ofwat. In 2017 there were around 70 locations utilising NAV’s, by late 2025 this had risen to 2,270 NAV locations.

As NAVs are regulated in the same way as other licensed operators they must meet the same strict water quality and environmental standards as incumbents — so you don’t compromise on quality. There are also protections in place to ensure connected customers do not pay more than the equivalent incumbent company charges for service.

Benefits and pitfalls

The are clear benefits of a NAV for a developer who understands and has experience of the competitive water connection market. These include:

- Lower connection costs

- Design flexibility and innovation

- Speedier delivery of infrastructure

However, there are also may challenges, the most common of which are:

- Inefficient procurement of NAV’s

- Poor quality NAV contracts

- Lack of understanding of future cash flows

How can Premier Energy help?

Premier Energy procured one of the first Residential NAV’s in early 2000’s, so we have over 25 years experience in the market.

If you are unsure whether a NAV is the right solution for your project then you need help from the experienced and independent consultancy team at Premier Energy. We can also offer CPD sessions on NAV’s to help your team understand this rapidly developing market.

As the leading independent utility consultancy we are well placed to help you on your next project. You can contact us at enquiries@premierenergy.co.uk or by calling 01403 740240 to discuss your project and explore how we can help you on your next scheme.